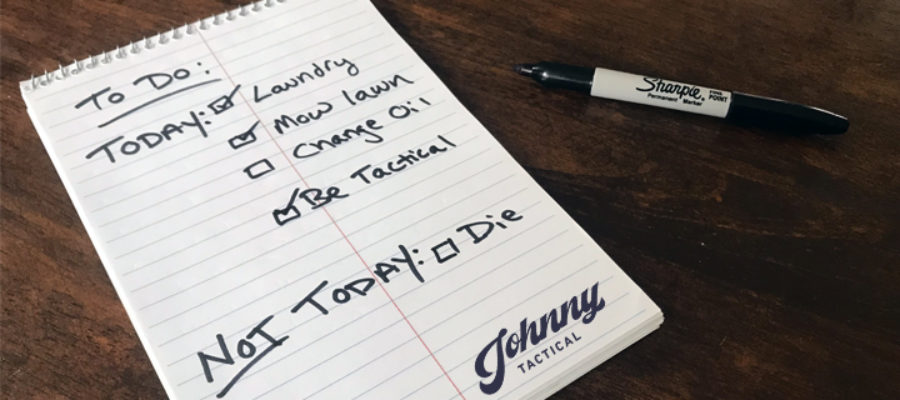

If you’re like me, dying is not on your list of things to do. Generally, I place dying over in the, “Maybe some other time, but not today” column when I’m planning my day. So far I’m happy to announce that that approach has worked.

However, after years of in-depth research, various studies, and the collection and analysis of vast amounts of data, I have found that humans have a 100% mortality rate. Shocking, I know. For those of us who try to beat the odds by not writing it in our planner, there’s still the chance of accident, injury, or dismemberment — which is exciting.

The thought of talking about bad things happening and having the right kind of insurance in place ranks somewhere between discussing the birds and the bees with middle-schoolers and hearing about Grandpa or Grandma’s latest colonoscopy. When faced with these topics a common reaction might be gritting your teeth and getting through it while you smile and nod or simply faking your own death. Suffice to say it’s probably nobody’s favorite topic and I would totally understand if you’d rather step in front of a bus.

But, because I believe you’re the kind of person who loves your family more than you hate learning about colons, I know you’ll power through this article and make sure you have the right insurance in place. Whether you are a police officer or not, if you have a family and people who depend on your income, you need to make sure you take care of them if you become unable to work or go out in a blaze of glory.

Here’s the five types of insurance you need and why:

Term Life Insurance

If you have a family of your own you need life insurance. (It should be called death insurance because they don’t pay you to stay alive, but I guess that’s too morbid and would hurt sales). When you get your policy don’t just pick a random number that sounds like a lot of money to you, because it probably won’t be enough. So how much do you need? You need a policy that will pay out 10 to 12 times your income. For example, if you make $100,000.00 a year, you need a 1 to 1.2 million dollar policy, or if you make $50,000.00 a year, you need a $500,000.00 to $600,000.00 policy.

Why 10 to 12 times your annual income? If your beneficiary (for you married guys, that’s your wives) puts that money ($1,000,000.00) into an investment that earns an average of 10%, then they will take home $100,000.00 a year (which sounds a lot like your income) and it will do that year after year without reducing the principle — ever! Translation: your family won’t have to worry about having a roof over their head or food on the table. That one move will prevent a personal tragedy from turning into a financial crisis.

Caution: The only type of life insurance you should get is Term Life Insurance. Never, ever buy a policy that has a cash value or an investment built into it or that falls under the umbrella of Whole Life, Universal Life, or Variable Life. Those kinds of policies claim to build up a savings account or an investment inside the insurance policy that you can use to grow your wealth. This is what is known as a lie. The truth is that Whole Life Insurance policies and the like are crappy investments with low rates of return, high fees, and when you die they keep your money and only pay out the face value of the policy. Maybe you missed that — they keep the money that you saved up inside your policy when you die! Let that sink in. Do your investing with an investment company and your insurance with an insurance company. When they get mixed you get screwed.

Health Insurance

This seems like a no-brainer because most of us get health insurance as a benefit through work. However, the number one cause of bankruptcy in America is medical bills. Not having health insurance is a terrible idea and will likely cost you a whole lot more in the long term. If you go through a transition period from one job to another and there is a lag between coverage, make sure you put something in place to cover the gap.

Compare health insurance plans, coverage, and cost if your employer offers more than one plan. If your spouse works, do the same with what their company offers and then choose the best one for your personal needs.

Pro Tip: Some companies, cities, and towns will pay you money to not have health insurance if you can get coverage through your spouse’s employer.

Caution: Avoid add-on policies like cancer policies or supplemental coverage like plans from Aflac. They will cost you more than they will pay out in the long run — that’s how they stay in business. Having short and long-term disability coverage and a personal emergency fund aside from health insurance is all you need should you get sick or injured.

Car Insurance

Though most states require car insurance, some don’t and it can be tempting to opt out or get the cheapest coverage known to man. Since everyone’s personal situation, income, and net worth will vary, sit down with a quality insurance broker to walk you through choosing the best policy and amount of coverage. One accident is all it takes to make you wish you had done the work up front.

Homeowners or Renters Insurance

Owning a home means owning a liability should Jim-Bob the delivery man take a tumble and having a mortgage means the bank actually owns it and wants their asset protected should you decide to do your own pipe-fitting for your gas lines. Your home is typically the largest asset you will ever own and it needs to be protected. If your policy hasn’t been updated to reflect current values, consider updating it as soon as possible.

One area people often overlook is Renter’s Insurance. They assume that the insurance policy their landlord has on the property will cover them in the event that their neighbor who smokes a pack a day and falls asleep watching Dr. Phil reruns only to light the curtains on fire and burn the building down. Unfortunately, without Renter’s Insurance everything you own will go up in smoke and you’ll be left with only what you can salvage. You need your own Renter’s Insurance policy to cover what you own in the event of fire or theft.

Pro Tip: Bundling your home, renter’s, and car insurance together will often save you money, but not always. Some of the insurance companies you see advertised every five seconds are not the best option, even though they have entertaining commercials. The best way to save money is to go through a local insurance broker who can shop the best prices from multiple companies. Then, review your policy every year and shop around because your needs will change and you may be able to get a better price than the year before.

Short-term & Long-term Disability

I don’t know about you but I never really worried about getting injured on the job. I figured if it happened, “they” would take care of me. This is what’s known as naive. Worker’s Comp is a headache at best and a complete scam at worst. The Worker’s Comp company does not care about you and wants to pay out as little as possible. Plus, if you get injured outside of work (something I was not smart enough to consider in the past) which prevented you from working, then Worker’s Comp doesn’t apply. Without Short-term and Long-term Disability insurance you can jeopardize your future.

Getting a policy through work is usually the cheapest way to get it, but you can always compare prices with a broker. It doesn’t cost much and is a must-have policy that will pay you a percentage of your salary should you fall off a ladder and break your neck while hanging Christmas lights or cleaning out the gutters.

Nerd Out

I know this is a boring topic, but it is often overlooked and misunderstood and full of scummy salesmen or incompetent human resource personnel with bad information. If you have people who depend on your income then it is your responsibility to plan for your worst day ever and make sure the one thing they don’t have to worry about is their basic needs. Show them you love them and be a good steward of your resources by getting the right insurance coverage today.

__________________________

Thanks for reading! Do you have a story that you think we could learn from and that you’d like to share with Johnny Tactical nation? Fill out the contact form and include your name, rank, and department, or email it to [email protected] and follow these guidelines:

– It must be a firsthand account

– True

– Have a lesson, principle, or tactic to apply

– Cleaned of names, dates, and places

– Include your call sign

If your story is selected and published in our blog you’ll get the credit using your call sign and we’ll send you a free Live Tactical t-shirt!

Leave a Reply

Your email is safe with us.

You must be logged in to post a comment.